Too often, life insurance is an afterthought. With many other financial to-do’s, you can't imagine, let alone think, about what happens if you're not around anymore. However, marriage, buying a home, or growing your family are vital moments when purchasing life insurance is more important than ever.

What is life insurance?

Life insurance is a tax-free lump sum payment, or death benefit, which goes to your named beneficiaries upon your death.

In exchange, you pay premiums, either annually or monthly, to the life insurance provider. Life insurance premiums vary greatly depending on your age, health, and the amount of money you'd like to leave behind.

When you die, your beneficiaries can use the money however they like. Generally, paying off debts, replacing income, paying off your mortgage, and funding your children's education are the primary targets.

Who needs life insurance?

If you have anyone who depends on you financially, you need life insurance. Kids, a significant other, or ageing parents, are signs that you probably need life insurance. Should you pass away suddenly, life insurance can help them financially.

On the other hand, if you're single and without kids, typically, you can forgo life insurance. Especially if you have enough savings or assets your family could liquify to cover funeral expenses and costs associated with your death (e.g. rent/mortgage payments, car payments, or other debts).

Life insurance is a personal choice, though. So, even if you don't fit within the "average" circumstances for those requiring life insurance, it's still valuable to review your situation to determine what's right for you. For example, if you want to make sure your ageing parents have enough to live off in the event you pass unexpectedly.

Know life insurance is cheaper the younger you buy into it.

How much life insurance do you need?

Determining how much you need starts with a simple rule of thumb. It's an acronym, DIME (debts, income, mortgage, education). DIME adds up your debts, income replacement, paying off your mortgage, and funding your children's education.

However, this is just a rule of thumb, so remember to speak with your family about your specific situation and coverage needs. For instance, they could sell the house, clear the debts, and buy something smaller in a cheaper region. Perhaps your significant other moves closer to their family for the extra support.

That said, the cost of your life insurance premium will vary significantly based on several factors, including:

● Age

● Gender

● Coverage amount

● Smoking status

● Health status

● Lifestyle

● Type of policy (term vs. permanent)

Term vs. Whole life insurance

You can buy Term policies for a set amount of years ranging from 1 to 100. Generally, they're available in 5-year increments and fall in the 20–40 year range.

On the other hand, whole life is a type of permanent life insurance policy that lasts your entire life or until you stop paying your premiums.

Whole life is more expensive than term life insurance. While the premiums don't increase because of your age, they can increase based on actuarial tables (i.e. death expectancy changes from the government). Often a whole life policy has a cash surrender value meaning you can cancel and cash out your policy for a pittance of its value. Still, as you age, if you can no longer afford the premiums in retirement, it's an option.

It's also why term life insurance may be more appealing. If life insurance is a financial safety net for your family, there's little sense continuing to pay premiums after you're mortgage-free, your kids are working, and you have a retirement nest egg.

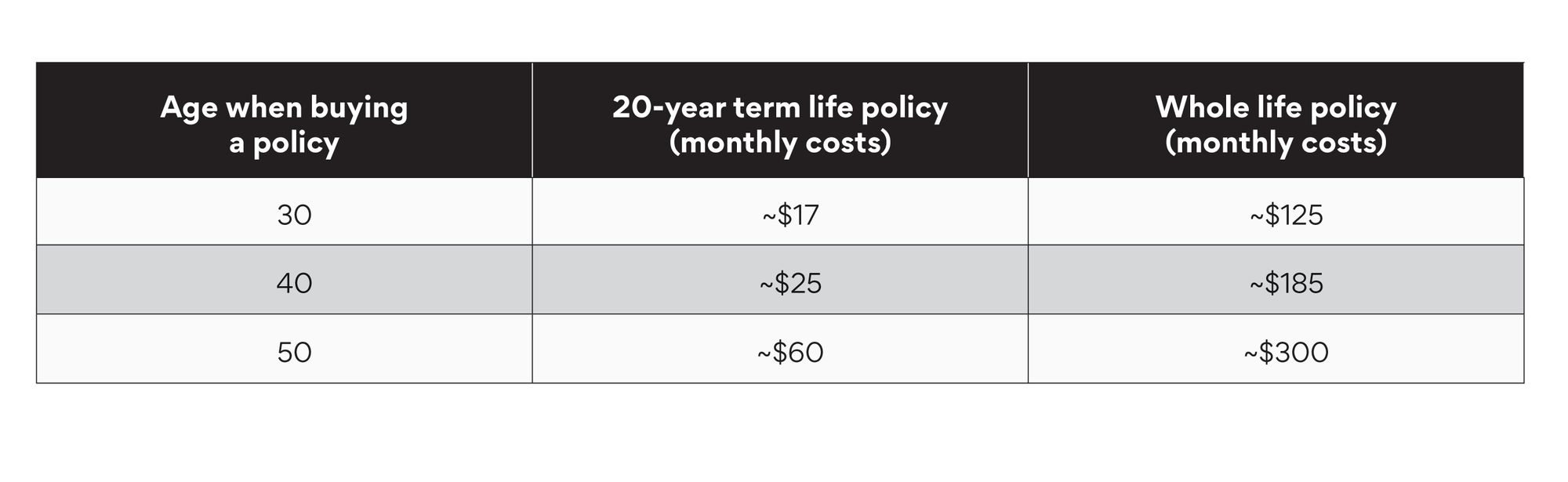

It's a choice, but one not to be taken lightly, especially when comparing pricing. For example, let's use a $250,000 policy and compare a term vs. whole life policy using different ages.

Pricing comparison: term vs. whole life insurance

How to buy life insurance

You can buy life insurance directly from a life insurance provider like Sun Life, Manulife, or Canada Life. Most big banks and major insurers like Wawanesa, Co-Operators, or Allstate also sell life insurance, which you can purchase through a life insurance broker.

As with any insurance purchase, it's essential to shop around and compare insurance quotes and coverages. One of the best ways to expedite and simplify the process is to compare life insurance quotes online. That way, you know that you're getting the best value based on your demographic criteria and policy needs.

Once you've chosen a provider and signed the contract, there is often a medical examination depending on the policy you choose. Sometimes if it's under $500,000, no medical exam is required, depending on the provider.

These assessments can be as simple as getting bloodwork and self-reporting your health status (e.g. age, weight, smoking) to a doctor's appointment with a full checkup. For seniors or those with pre-existing conditions, don't worry; you still have options. Best to be honest here, any misrepresentation of facts can lead to a quick policy dismissal or, worse, a denied claim.

One small note to close: mind the exclusions. High-risk activities like sky-diving or suicide within two years of your policy start date aren't covered. Read the fine print with your broker or agent.

In the end

Rest easy with a policy in place and financial security for your family. Put in the time to explore your options and to understand what works best for your situation.

At Ratehub.ca we make it easier for Canadians to choose better personal finance. With the best tools, rates and knowledge to help you take control of your money.

Whether it’s a mortgage rate or insurance rate, a credit card, chequing account or high-interest savings account, we are your champions of choice.